INTRODUCTION

The dynamic and transformative evolution in the flexible packaging industry has been sublime. Evolution within the flexible packaging industry has been immense in the past few decades. As the shift continues to occur, industries are majorly focusing on developing sustainable solutions for the flexible packaging industry. The growing retail industry in India is driving the shift of more markets into flexible packaging. With considerable number of players shifting into the market, the flexible packaging industry is expected to keep growing and increasing its share.

Let us take a look at the predictable growth of the flexible packaging industry, both in the Indian market and overseas

Trends in Flexible Packaging – A Historical to Contemporary Analysis

- Old Trends in Flexible Packaging:

1.Basic Materials: Historically, materials like cellophane and waxed paper were among the first to be used for flexible packaging.

2.Function Over Form: Initial designs were more function-focused, prioritizing protection and preservation over consumer appeal.

3.Limited Customization: Earlier, there was less emphasis on customization, leading to generic packaging designs.

4.Minimal Sustainability Concerns:The industry had little focus on recyclability or biodegradability.

Contemporary Developments: Latest Trends in Flexible Packaging

1.Ubiquitous E-Commerce:

- The rise of e-commerce demands rigorous focus on packaging adaptability to accommodate new product varieties.

- Innovations in “last-mile” delivery mechanisms are paramount.

2.Evolving Consumer Preferences:

- Consumers are increasingly seeking personalization, convenience, health-conscious options, and affordability in their choices.

- This will consequently drive Stock Keeping Unit (SKU) diversification to unprecedented levels.

3.Margin Pressure in FMCG and Retail:

- Fast-moving consumer goods (FMCG) manufacturers and retailers are contending with escalating margin compressions.

- This financial strain inevitably cascades up the supply chain, amplifying solvency risks for converters.

4.Augmented Sustainability Imperatives:

- Every facet of the value chain is experiencing intensified sustainability mandates.

- This trend is underscored by mounting scrutiny from environmental activists and informed consumers.

5.Digital Transformation & IoT Integration:

- The integration of digitization and the Internet of Things (IoT) is not just a cost-containment strategy but also a vehicle to gain a competitive advantage.

- By the end of this decade, technology embedded within packaging is anticipated to deliver enhanced customer value and service, further enriching the consumer experience.

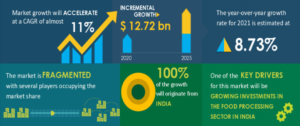

Market Trend

Overseas

- Contemporary market analytics underscore a pronounced growth in the demand for dairy commodities. Illustratively, data from the United States Department of Agriculture (USDA) positions Europe at the zenith of per capita cheese consumption. In 2021, the European Union reported an average intake of 20.44 kilos of cheese per individual. Notably, the United States and Canada trailed, registering consumption figures of approximately 17.9 and 15 kg respectively.

- Milk stands as an indispensable dietary staple, renowned for its abundant calcium and essential nutrient content. Comprehensive reports from international organizations such as the Food and Agriculture Organization of the United Nations (FAO) and the US Department of Agriculture attest to India’s prominence in this domain, having consumed an estimated 83 million metric tonnes of cow milk in 2021—making it the globe’s foremost consumer. The European Union followed, accounting for a consumption of 23.9 million metric tons

- Evolving market preferences have accelerated the adoption of film-based vacuum pouches, notably those with moderate (PA/PE) or high barrier (PA/EVOH/PE) properties. These state-of-the-art pouches, frequently employed in Modified Atmosphere Packaging (MAP) systems, are predominantly designated for dairy and protein-centric packaging solutions

Indian

- Food Industry is Expected to Hold the Largest Share in the Market.

- Based on data from the India Brand Equity Foundation (IBEF), food and grocery sales account for roughly 70% of India’s total retail transactions. The urban market’s departmental retail stores and unit packaging in rural areas significantly propel flexible packaging demand. As per the USDA Foreign Agricultural Service, India had 12.79 million traditional retail grocery outlets in 2021, anticipated to exceed 13.05 million by mid-2023. This burgeoning retail sector is poised to amplify the need for flexible packaging within the food domain.

- Amid the COVID-19 outbreak and ensuing lockdowns, India saw a marked rise in online food ordering, leading to a surge in the packed food sector. According to MARC India, the market for packed food is projected to reach USD 3.4 billion by 2027. Major delivery services like Swiggy and Zomato broadened their reach to second and third-tier cities, resulting in a noticeable uptick in the use of containers like bowls and trays.

Market Analysis of Flexible Packaging –

Flexible packaging, characterized by materials like plastic, foil, and paper, has garnered significant attention due to its adaptability, weight advantages, and space efficiency. The market dynamics in overseas regions and India are shaped by several common and region-specific factors.

Overseas Markets

- The overseas market, especially in regions like North America and Europe, has seen steady growth due to technological advancements and sustainability initiatives.

- Opportunities: Rise of e-commerce boosts demand for durable and lightweight packaging. Increased consumer awareness about sustainable solutions offers avenues for biodegradable and recyclable packaging.

- Challenges: Stricter environmental regulations and recycling complexities. High competition leading to pricing pressures.

Indian Markets

Market Growth: Rapidly expanding due to increasing urbanization, growing middle-class consumer base, and modern retail channels.

Opportunities: Booming food and beverage sector requiring high-quality packaging.

Increasing emphasis on sustainable and locally sourced materials, leading to innovative solutions.

Challenges: Fragmented market with many unorganized players. Waste management and recycling infrastructure lag compared to western countries.